Blog

03/29/2016

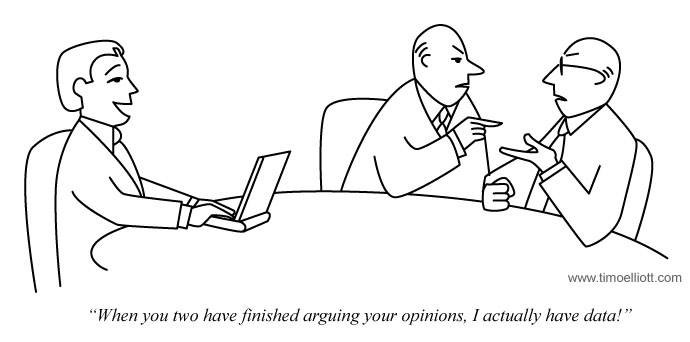

Without Accurate Sales Data You Are Just Another Sales Manager With An Opinion!

Many industry researchers, agree that 90% of spreadsheets contain so much inaccurate self-reported data that they are unusable… Read More

03/29/2016

SWOT Analysis For Commercial Lending Group

from the desk of Ron Buck Commercial Lending Case Study Many of our clients are involved in a… Read More