CRM Designed to Keep You Selling

When you need to stay laser-focused on the right deals, Pipedrive is here to support you.

Full access. No credit card required. Used by over 90,000 companies.

Fully Certified Pipedrive Elite Partner for Over a Decade

The Fastest Growing CRM for Financial Services

Pipedrive for Financial Services is Pipedrive tailored to the needs of your financial institution. Learn how a CRM solution boosts your sales, and why so many of the fastest growing and most efficient financial institutions rely on Pipedrive for Financial Services.

- Banks

- Credit Unions

- Morgage Lenders

- SBA Lenders

- Fintechs

- Financial Advisors

- Insurance Agencies

Expect More From Your CRM

Learn how a CRM solution boosts your sales and why so many of the fastest growing and most efficient financial institutions rely on Pipedrive for Financial Services. Pipedrive for Financial Services is Pipedrive tailored with the right technology for your financial institution with hand-on dedicated support and professional services.

average increase in close rate after users’ first year

CRM in software Reviews’ Data Quadrant 2018 and 2019

worth of closed deals for 90,000+ companies

seconds or less customer support response time

Star rating for ‘ease of use’ by Capterra

Used by over 90,000 companies in 179 countries

Some of the Markets We Serve

Financial institutions of all sizes are using Pipedrive for Financial Services. Leaders in banking like Umpqua Bank, South State Bank, and BBVA. Insurance agencies like The Insurance Center. Leasing companies like Financial Pacific Leasing. Fintechs like Shore Funding Solutions. As well as SBA lenders, mortgage lenders and financial advisors all over the world.

Some of Our Hundreds of Prestigious Clients

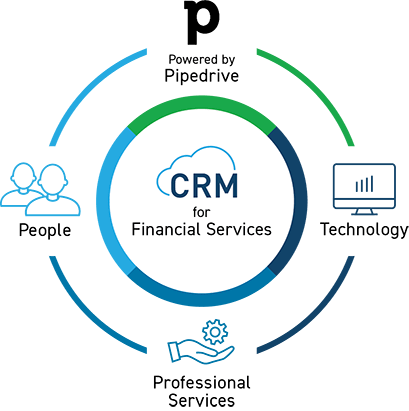

Pipedrive for Financial Services

Your CRM initiative needs to include technology, but it should not be about technology. You will need the support of the right people and professional services.

Performance Insights, in partnership with Pipedrive, has tailored Pipedrive for financial institutions by adding additional technology, professional services, and people with decades of experience in financial services.

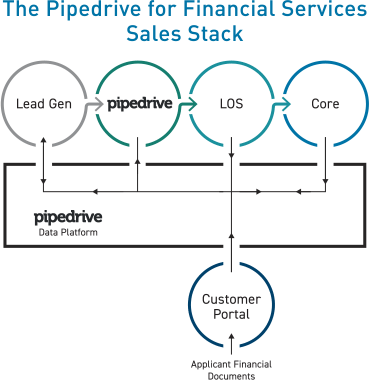

Pipedrive Data Platform Integration and Automation

The Pipedrive data platform integrates and automates your entire sales stack and adds these additional capabilities:

- Custom reports, dashboards and analytics using data from the entire sales stack.

- Alerts, notifications and inter-stack communications.

- A customer 360 data mart

- Auto-updates

- A customer portal for automated financial document collection and management.

- Open API connectors for all loan origination systems (LOS), core processors, marketing software and hundreds of other systems and apps.

A Results-Driven Team

Our results-driven team of experienced professionals with hundreds of CRM installations with financial institutions:

Nick Bono

COO & Pipedrive Master

Nick has been working with financial institutions for over 10 years. He has installed hundreds of CRM systems. Nick manages a team of software developers, Pipedrive Masters, systems integrators and support team members.

Pipedrive Masters

Our clients are assigned a dedicated team of Pipedrive Masters to guide them through the entire process from design, configuration, systems integration, training and on-going support.

With hundreds of installations over two decades with the world’s most demanding and prestigious financial institutions, our Pipedrive Masters know how to make your CRM initiative successful by sharing ideas!

Our Pipedrive Masters are setting New Performance Standards & Customer Satisfaction by delivering results.

Time-to-Launch

Pipedrive users report that their installation and training was 100% on time.

50% of installations are in less than one week.

Sales Goal Attainment

Pipedrive users report a 36% increase in goal attainment compared to before using Pipedrive.

Total Cost of Ownership

Pipedrive users report 62% less TCO than their previous CRM system.

Employee Engagement

Pipedrive users report that their employees are more engaged, and they have 78% greater utilization than their previous CRM system.

ROI

On average, Pipedrive users report a 100% ROI in the first six months.

Experience-Driven Solutions for High Performing Financial Institutions

Customer Relationship Management (CRM) is essential to succeed in today’s exciting but challenging marketplace. Those who master the use of CRM software can vastly improve their win rates and overall sales velocity far surpassing competitors. Pipedrive for Financial Services’ data platform integrates the entire sales stack and provides the following benefits:

Automated Custom Reports, Dashboards and Analytics

Simplify processes through the elimination of all spreadsheets. This includes sales reports, loan origination reports, credit administration dashboards and machine learning customer analytics.

Integrated Sales Stack

The integration of sales, marketing, loan origination, credit and finance processes allows everyone in the organization—from a frontline sales person to board of directors—to use the same accurate data and the metrics that matter to make critical decisions.

Focused Goals

Everyone is focused on ‘what’s important’ instead of arguing about ‘who’s right’.

Increased Confidence

Frontline sales managers are managing and coaching with more confidence.