Sales Execution Trends Briefing

for Business, Commercial, Treasury, Wealth and Private Bankers

2016 Trends

Executive Summary

Over the past year, we have surveyed thousands of Sales Metrics That Matter newsletter readers – executives and sales leaders from small business lending, commercial, treasury, wealth and private banking. We have created a comprehensive and ongoing study of sales execution at the frontline.

Not surprisingly, key priorities for sales executives in 2016 remain focused on increasing win rates (94%) and improving goal attainment (87%). Interestingly, increasing win rates has risen in importance, while closing more business at a lower cost dropped, further validating that the majority of banks remain in a growth mode.

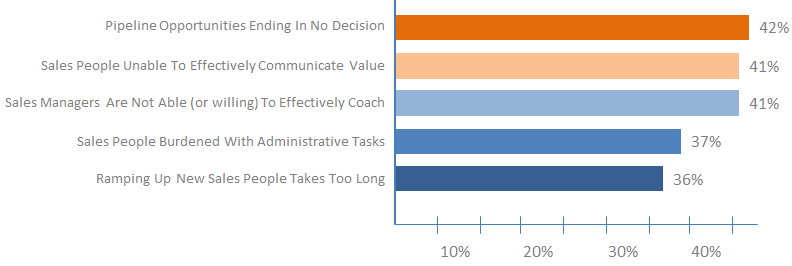

With increasing win rates being the most important to sales executives; it is especially noteworthy to see the leading reasons for not reaching goal attainment for banks this year.

As buyers are presented with more choices in an increasingly complicated and ever-changing landscape, Sales People Unable To Effectively Communicate Value as a reason for not reaching their goals is of little surprise. To support this finding, Forrester’s research indicates that only 10% of business leaders who meet with a banker say they received anything of value from the meeting – and, subsequently, only 17% of bankers are able to get a second meeting.

To further add to the already complex environment the pressure to sell more effectively to an increasingly savvy buyer is at an all-time high. Understandably, survey respondents indicated their objectives for optimizing revenues as (1) capturing new accounts (69%), (2) upselling / cross-selling existing accounts (48%), (3) retention (42%), (4) increasing sales effectiveness (39%), and (5) increasing win rates of forecasted deals (36%).

The Relentless Hurdle to Goal Attainment

Today’s selling environment is rapidly changing from one day to the next as buyers and salespeople alike are inundated with what to buy and how to sell it.

An ongoing commitment to change is a necessary component of any successful onboarding initiative, without which new hire progress is doomed to stall and prolong an otherwise successful selling year. At the same time, it takes a new sales rep an average of 7-9 months to be fully productive (and over a year for small business), slowing down time to revenue, and applying added pressure to sales leaders.

Regardless of bank size, sales organizations struggle with slow ramp up time for new salespeople with only 3% ramping up new salespeople in less than 3 months, and 71% taking longer than 6 months. Small business teams struggle with onboarding and, ultimately, never adequately onboard 45% of their new employees.

The continuous struggle to ramp up (onboard) new hires faster is a serious detriment to a bank’s bottom line.

Eighty percent (80%) of banks that rate ‘ramping up new sales reps’ as very important to reaching their sales goals, report poor coaching and the lack of a specific onboarding plan as major obstacles.

Year after year, at least 60% of sales people fail to hit their goals. What’s more, survey respondents report only 41% of forecasted pipeline opportunities actually result in wins. Even among banks that report a high degree of confidence in goal attainment, the same applies – only 40% of forecasted to close opportunities result in actual wins.

Weak forecast predictability reveals the need for all banks, even those confident in goal attainment, to reassess their predictions and ask, ‘what about the remaining 60%’? How will sales organizations reach their goals if the vast majority of deals are likely to result in stalled/no decision or losses?

When asked to assess the performance of key areas in the sales cycle, banks revealed the following top areas in need for improvement:

- New sales people inability to identify and gain access to key decision makers (58%)

- In ability to add-value to the sales conversation early in the sales cycle (56%)

- Conduct a thorough needs analysis and translate those needs into a powerful value-proposition that clearly differentiates versus the competition (54%)

- Close deals in the timeframe originally forecasted (43%)

The Disconnect Between What The Buyer Wants And How The Sales Person Articulates The Bank’s Value Proposition Is At The Crux Of A Persistent Problem.

We call this the Performance Gap – the gap between a bank’s sales strategy and its ability to execute that strategy.

Increasing lack of sales alignment and focus on one or two wildly important goals and the inability to add value to the sales conversation and build trust both contribute to the cycle of inefficiency in sales organizations.

From our survey data, it is evident that pipeline management stands in the way of most bank sales organizations, with 28% of those surveyed reporting the inability to generate enough qualified leads (68% for small business) and 69% reporting inaccurate pipeline forecasts as top challenges to achieving sales objectives.

Overall, since 2015, the inability to generate enough qualified leads has dropped by 17% (except small business) but inaccurate pipeline forecasts have increased 23% – revealing that while the top of the funnel may be improving, the middle and end of the funnel continues to struggle. However, 72% of banks indicated they have very little visibility into each stage of the pipeline – indicating a lack of important coaching insights.

It’s All About Efficiency

Today’s world moves faster than ever. With competition on the rise and rate pressures, improving sales efficiency is critical to the bank’s bottom line. But just how to do so is a whole other question

Our survey respondents indicated that one of their leading challenges is the inability (or unwillingness) of sales managers to coach effectively (48%). This is a material jump for our 2015 survey (15%), revealing the growing need of real-time coaching and opportunity management.

As important, over 73% of all survey respondents indicate that a lack of interconnected systems (CRM, Loan Origination System, Core, etc.) may be exacerbating the coaching problems because they are unable to create reports (with a reliable frequency) that everyone trusts, with important insights that are designed for individual performance improvement. A shocking 65% report their critical sales systems are not at all connected and spreadsheets are on the rise.

Spreadsheets waste valuable internal resources and contribute to data inaccuracy.

Of the banks that are confident in their sales teams achieving sales goals, over 77% stated their sales systems are totally connected through one interface that is streamlined for the frontline sales force. Sales execution and achieving sales goals requires consistency, along with accurate and timely sales data that everyone trusts.

Sales analytics allow sales leaders to identify patterns and indicators of success – or failure. Without visibility into the entire sales pipeline, forecasting is inaccurate, decisions are ad hoc in practice, and bottlenecks in sales processes are inadequately, if ever, addressed. On average 68% of banks reported their current sales analytics do not meet their needs – or worse, they don’t have any at all.

Although virtually all banks create reports, 85% of bank sales teams use manually-prepared spreadsheets that are inaccurate, infrequent and very light on analytic depth (critical insights).

Although the lack of coaching is a critical performance barrier, 85% of banks do not have the trusted reporting necessary to support coaching.

These themes all pivot on the fact that banks continue to struggle with sales execution.

Would You Like To Know More?

Our research revealed the critical issues to be addressed but it also revealed answers – exciting best practices related to sales skills, sales execution, onboarding, coaching, sales reporting and analytics, systems integration and process improvement. We found banks that are aggressively addressing these critical issues and developing new best practices we call The Behaviors of High Performers.

Ron Buck has developed a two hour Sales Execution Trends Briefing that outlines the behaviors of high performers and provides your team with the full research study. There is no fee for this onsite briefing. If you would like to know more and receive a briefing, contact Ron Buck.

Ron Buck

480-212-6082